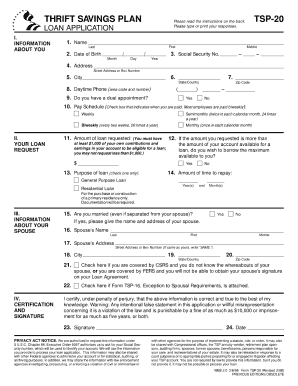

Get the free tsp form pdf

Show details

Work-Related Injury / Illness Case Management Procedure g (TSP-21) For Contractor Communication Thailand Profit Center March 2011 2011 Chevron Corporation. All rights reserved. Case Management Purpose

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tsp 21 g form

Edit your tsp 21 g form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tsp 21 g form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tsp form 21g pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tsp form 21. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form tsp 21 g fillable

How to fill out tsp 21 g form:

01

Gather all necessary information and documents, such as your personal details, beneficiary information, and financial information.

02

Read the instructions carefully to understand the requirements and procedures for filling out the form.

03

Start by providing your personal information, including your full name, social security number, and contact details.

04

Fill in the beneficiary section, entering the required details of the person(s) who will receive your Thrift Savings Plan (TSP) savings in the event of your death.

05

Provide accurate and up-to-date financial information, including your TSP account number and balance, as well as any changes you wish to make to your investment allocations.

06

Sign and date the form, ensuring that you have completed all necessary sections and provided any supporting documentation required.

07

Make a copy of the completed form for your records before submitting it according to the instructions provided.

Who needs tsp 21 g form:

01

Active federal employees who have a Thrift Savings Plan (TSP) account.

02

Individuals who wish to designate or change beneficiaries for their TSP account.

03

Those who want to update their investment allocations within their TSP account.

04

Employees who need to provide or update their financial information for TSP purposes.

05

Anyone who wants to make any other changes or updates to their TSP account.

Note: It is always recommended to consult the official TSP website or contact your HR department for any specific guidance related to filling out the TSP 21 g form, as requirements and procedures may vary.

Fill

tsp 21 g fillable

: Try Risk Free

People Also Ask about tsp 21 g printable form

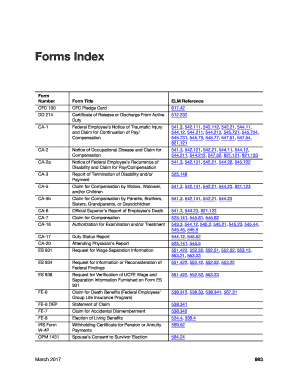

What tax form do I get for TSP withdrawal?

IRS Form 1099-R — In mid-January, the TSP will mail IRS Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., to participants who received a withdrawal between January 1 and December 28, 2022, and/or a taxed or foreclosed loan between January 1 and

How do I upload TSP form?

Submitting certain forms online — You may now submit certain TSP forms online by logging in to My Account and uploading a PDF copy of the form. You'll find an up-to-date list of forms we accept online when you log in to My Account and select Upload Form from the menu.

How do I get a TSP withdrawal form?

To request a TSP withdrawal or distribution, log in to My Account to begin the request. You don't need to complete a paper withdrawal form.

Where can I find TSP?

You can find your Thrift Savings Plan (TSP) by checking your quarterly or annual account statement. If you do not have a copy of your statement, you can contact TSP at 1-877-968-3778 to request a mailed copy of your statement.

What form do I need to rollover my TSP to an IRA?

Filling Out Form TSP-70 Request for Full Withdrawal. If you are doing a full withdrawal (transfer or rollover of the entire contents of your TSP), then you will need to fill out pages 1, 2, and 4 (Traditional Balance) and/or Page 5 (Roth Balance).

What form is used to transfer TSP to IRA?

foRm tSp-60 InStRUCtIonS Use this form to request a transfer or to complete a rollover of tax-deferred money from an eligible retirement plan into the traditional (non-Roth) balance of your Thrift Savings Plan (TSP) account. You must have an open TSP account with a balance when your request is received by the TSP.

How do I request a withdrawal from my TSP?

Submit your withdrawal forms directly to the TSP Service Office. To reach the Service Office, call the TSP ThriftLine at 1-TSP-YOU-FRST (1-877-968-3778) or the TDD at 1-TSP-THRIFT5 (1-877-847-4385). Outside the U.S. and Canada, please call 1-504-255-8777.

Do I need notary for TSP withdrawal?

To show the spouse's consent and waiver, a participant must submit to the TSP record keeper a properly completed withdrawal request form, signed by his or her spouse in the presence of a notary.

How do I request a full withdrawal from my TSP?

Submit your withdrawal forms directly to the TSP Service Office. To reach the Service Office, call the TSP ThriftLine at 1-TSP-YOU-FRST (1-877-968-3778) or the TDD at 1-TSP-THRIFT5 (1-877-847-4385). Outside the U.S. and Canada, please call 1-504-255-8777.

What is a TSP 99 form?

TSP-99: Withdrawal Request for Separated and Beneficiary Participants. Handled via My Account** *New Forms/Process Key: Handled via My Account – form is not directly accessible online; process should be started via My Account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tsp 21 g form?

Tsp 21-G refers to the Form TSP-21-G, which is used by Thrift Savings Plan (TSP) participants to designate beneficiaries for their accounts. TSP is a retirement savings and investment plan for federal employees and members of the uniformed services. The form allows participants to designate individuals or entities to receive their TSP account balance in the event of their death.

Who is required to file tsp 21 g form?

The TSP-21-G form is used to designate or change a beneficiary for Thrift Savings Plan (TSP) accounts. It is typically filed by TSP participants who want to designate or update their beneficiary information.

How to fill out tsp 21 g form?

The TSP-21-G form, also known as the Thrift Savings Plan Interfund Transfer Request, can be filled out following these steps:

1. Download the TSP-21-G form from the official Thrift Savings Plan website.

2. Read the instructions on the form carefully to understand the requirements and conditions.

3. Provide your personal information: Fill in your name, address, TSP account number, and Social Security number in the designated sections.

4. Indicate the amount and type of transfer: Enter the amount you wish to transfer from one fund to another in the "dollar amount" field. Choose the specific TSP funds involved in the transfer by marking the appropriate boxes.

5. Determine the transfer date: Select the desired date for the transfer to occur. Note that transfers can be scheduled for either a fixed date or a percentage of pay.

6. Signature and date: Sign and date the form to certify that the information provided is accurate and complete.

7. Submit the form: After completing the form, send it to the Thrift Savings Plan by mail or fax. Ensure you keep a copy for your records.

It is important to note that the TSP-21-G form only allows transfers within the Thrift Savings Plan and cannot be used for any other purpose.

What is the purpose of tsp 21 g form?

The TSP-21-G form is a document used by the Thrift Savings Plan (TSP), which is a retirement savings and investment plan for federal employees in the United States.

The purpose of the TSP-21-G form is to designate a beneficiary or beneficiaries who will receive the TSP account balance in the event of the account holder's death. It allows TSP participants to specify how their account will be distributed and who will receive the funds upon their passing. This form provides the necessary information for the TSP to ensure that the account holder's wishes are carried out.

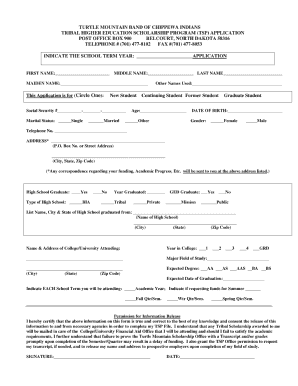

What information must be reported on tsp 21 g form?

The TSP-21-G form is used to report a deceased participant's account information and determine the distribution of their Thrift Savings Plan (TSP) balance. The following information must be reported on the TSP-21-G form:

1. Participant's Personal Information: This includes the full name, Social Security number, date of birth, date of death, and contact information of the deceased participant.

2. Beneficiary Information: The form requires details such as the full name, Social Security number, relationship to the deceased participant, and percentage allocation for each beneficiary.

3. Account Information: The account number, account balance, and the type of TSP account (e.g., traditional, Roth) should be provided on the form.

4. Distribution Choices: The form requires you to select a distribution option for the TSP account balance, which may include a lump-sum payment, monthly payments, or a combination of both.

5. Tax Withholding: You need to specify the federal income tax withholding rate to be applied to the distribution amount. Options include no withholding, a specific dollar amount, or a percentage of the distribution.

6. Spousal Consent: If the participant had a spouse at the time of death and wishes to choose a distribution option other than a joint life annuity, spousal consent is required.

It is important to carefully complete the TSP-21-G form to ensure the accurate distribution of the deceased participant's TSP account balance.

How do I modify my print tsp 21 g in Gmail?

findform tsp 21 g and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send print blank tsp 21 g to be eSigned by others?

Once you are ready to share your blank tsp for 21 g, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit form tsp 21 g page 2 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing form tsp 21 g.

Fill out your tsp form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Printable Tsp 21 G Form is not the form you're looking for?Search for another form here.

Keywords relevant to tsp 21 form

Related to tsp 21 fillable form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.